All Categories

Featured

Table of Contents

Eliminating representative settlement on indexed annuities permits for considerably higher illustrated and actual cap prices (though still significantly reduced than the cap prices for IUL policies), and no question a no-commission IUL plan would push illustrated and actual cap rates higher. As an apart, it is still feasible to have an agreement that is really rich in agent compensation have high very early cash abandonment values.

I will certainly concede that it goes to least in theory feasible that there is an IUL policy around provided 15 or twenty years ago that has actually provided returns that transcend to WL or UL returns (more on this below), yet it's important to better understand what a suitable comparison would certainly require.

These policies generally have one lever that can be evaluated the firm's discretion every year either there is a cap rate that defines the maximum attributing price in that specific year or there is an engagement price that specifies what percent of any favorable gain in the index will certainly be passed along to the plan because specific year.

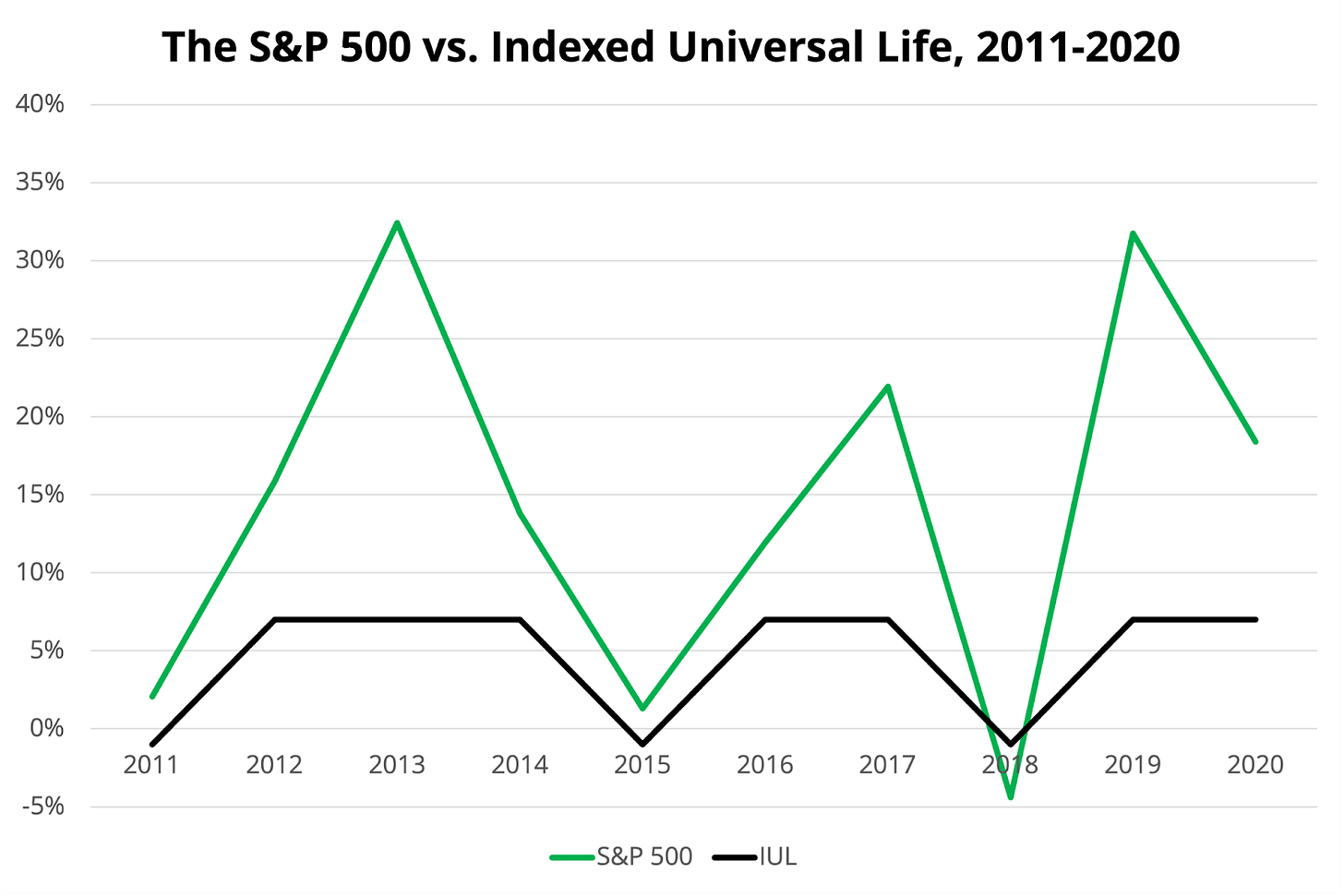

And while I normally agree with that characterization based upon the auto mechanics of the policy, where I take problem with IUL supporters is when they characterize IUL as having remarkable go back to WL - iul result. Many IUL proponents take it an action even more and indicate "historical" data that appears to support their claims

There are IUL plans in presence that carry even more threat, and based on risk/reward concepts, those policies need to have higher expected and actual returns. (Whether they in fact do is an issue for significant discussion however firms are utilizing this approach to aid validate higher detailed returns.) Some IUL plans "double down" on the hedging method and examine an added charge on the plan each year; this charge is after that used to increase the alternatives budget; and after that in a year when there is a favorable market return, the returns are magnified.

Group Universal Life Cash Accumulation Fund

Consider this: It is feasible (and actually most likely) for an IUL plan that averages a credited price of say 6% over its initial one decade to still have a general unfavorable price of return throughout that time because of high charges. Many times, I discover that representatives or customers that extol the performance of their IUL policies are perplexing the credited price of return with a return that properly mirrors every one of the policy charges also.

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

Next we have Manny's question. He says, "My good friend has been pushing me to get index life insurance policy and to join her service. It resembles an online marketing. Is this a great concept? Do they really make exactly how much they claim they make?" Let me begin at the end of the inquiry.

Insurance coverage salesmen are not bad people. I utilized to market insurance at the beginning of my profession. When they offer a costs, it's not unusual for the insurance coverage business to pay them 50%, 80%, also in some cases as high as 100% of your first-year costs.

It's hard to offer because you got ta always be trying to find the next sale and mosting likely to discover the next person. And specifically if you don't really feel very convicted concerning the important things that you're doing. Hey, this is why this is the very best option for you. It's mosting likely to be hard to locate a whole lot of gratification in that.

Let's talk regarding equity index annuities. These things are preferred whenever the markets are in an unpredictable period. You'll have surrender durations, normally 7, 10 years, maybe also past that.

Indexed Universal Life Insurance Complaints

That's just how they know they can take your cash and go completely spent, and it will certainly be all right because you can't obtain back to your cash till, once you're into seven, ten years in the future. No matter what volatility is going on, they're possibly going to be great from a performance viewpoint.

There is no one-size-fits-all when it comes to life insurance policy./ wp-end-tag > In your active life, monetary independence can seem like an impossible goal.

Pension, social security, and whatever they 'd managed to save. It's not that easy today. Fewer employers are providing standard pension plans and numerous companies have actually minimized or stopped their retirement and your capability to count only on social safety and security remains in concern. Even if advantages haven't been lowered by the time you retire, social safety alone was never meant to be sufficient to spend for the lifestyle you want and are entitled to.

Universal Index Annuity

/ wp-end-tag > As component of an audio financial strategy, an indexed universal life insurance coverage plan can assist

you take on whatever the future brings. Prior to committing to indexed universal life insurance coverage, here are some pros and cons to take into consideration. If you choose an excellent indexed global life insurance strategy, you may see your money worth grow in value.

If you can access it early on, it may be useful to factor it right into your. Given that indexed global life insurance policy requires a specific level of danger, insurance business tend to maintain 6. This kind of strategy also offers. It is still assured, and you can adjust the face amount and riders over time7.

Last but not least, if the selected index does not do well, your cash money worth's development will be influenced. Commonly, the insurance policy firm has a vested interest in performing better than the index11. However, there is usually an assured minimum rates of interest, so your strategy's development will not drop below a certain percentage12. These are all factors to be thought about when picking the very best type of life insurance policy for you.

Because this type of policy is extra complex and has an investment part, it can commonly come with higher costs than other policies like whole life or term life insurance coverage. If you don't assume indexed global life insurance is ideal for you, right here are some alternatives to think about: Term life insurance is a short-lived plan that commonly offers coverage for 10 to thirty years.

Ul Mutual Life Insurance

When deciding whether indexed global life insurance policy is appropriate for you, it is necessary to take into consideration all your alternatives. Whole life insurance may be a far better option if you are searching for more stability and uniformity. On the other hand, term life insurance might be a much better fit if you just need insurance coverage for a particular amount of time. Indexed global life insurance policy is a kind of plan that offers extra control and versatility, along with greater money value growth possibility. While we do not offer indexed universal life insurance policy, we can supply you with more info concerning entire and term life insurance policy plans. We suggest checking out all your alternatives and chatting with an Aflac agent to discover the most effective fit for you and your family members.

The rest is included in the cash worth of the policy after fees are deducted. The cash worth is credited on a month-to-month or annual basis with interest based on boosts in an equity index. While IUL insurance might prove important to some, it is essential to recognize just how it functions prior to purchasing a plan.

Latest Posts

Why Indexed Universal Life Might Be The New 401k

Universal Vs Whole Life Comparison

Universal Life Death Benefit Options